Limited Liability Partnership

LLP is a Limited Liability Partnership formed under the Limited Liability Act, 2008. LLP is

a body corporate and legal entity separate from its Partners. LLP has the combination of

both the Private Limited Company and Partnership.

The Limited Liability Partnership Act, 2008 A corporate business vehicle that enables

professional expertise and entrepreneurial initiative to combine and operate in flexible,

innovative and efficient manner, providing benefits of limited liability while allowing its

members the flexibility for organizing their internal structure as a partnership.

Advantages and Benefits

| LLP is a combination of both the Private Limited Company and the Partnership Firm providing benefits of both the structures. |

| LLP structure is more tax- friendly and cost- friendly as compared to Private Limited Company. |

| LLP involves less-compliances as compared to Private Limited Company.LLP provides a Digital identity to the Business specially to the startups and new business owners. |

| LLP structure is preferred by small and medium size business owners as it is cheaper to start and maintain. |

| LLP is a new legal structure for the small Business owners which offer immense tax benefits. |

| In LLP one Designated Partner is not responsible for the acts of other Partners. |

| There is no minimum capital required to start Business in LLP. |

Documents Required for LLP registration:

- Clear self-attested copy of the PAN card and Aadhar card of all the Designated Partners.

- E-mail ID and Mobile number of all the Designated partners of the LLP.

- Colored photographs of the Designated partners of the LLP.

- Brief description of the Business activities to be carried out by the LLP along with the four proposed names you wish to apply.

- Passport and Bank statement of the Designated Partners showing address with current transaction of the Designated Partners.

- Latest Electricity Bill (not older than 2 months) of the proposed registered office of the LLP.

LET’S CLEAR ALL THE DOUBTS!

Ans:- It depends on the type of Business you wish to start or the turnover of the existing Business. LLP is preferred for a start-up as the start-up wants to keep the cost Minimum.

Ans:- Yes LLP can be converted into Public Limited Company or Private Limited Company after the completion of the Formalities as prescribed by the Ministry of Corporate Affairs. It takes usually time of 15 to 30 days for the conversion.

Ans:- Yes it is perfect. LLP is mostly preferred by service sector business owners. LLP is the most preferred legal structure by the professionals such as Chartered Accountants, software engineers etc.

According to LLP Act, 2008 Rule 24 (8) exempt the LLP from the Audit of its accounts if its turnover does not exceed, in any financial year, Rs. 40 lakhs or its contribution does not exceed Rs. 25 Lakhs.

Ans: As soon as your turnover exceeds 40 lakhs Audit of books of Account is necessary as per the LLP Act, 2008.Rest of the Compliances remain the same.

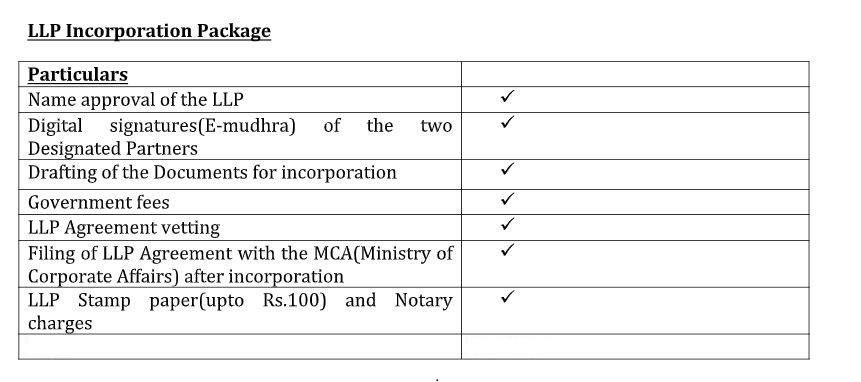

- Step 1:- We apply for the name with the Ministry of Corporate affairs i.e. two names initially.

- Step2----As soon as the name gets approved we apply for the Digital signatures of the Designated Partners.

- Step 3--- As soon as the Digital signature gets ready we send the Documents for signing and File the Documents with the Ministry of Corporate Affairs.

- Step 4:- As soon as the LLP is incorporated we receive the Certificate of incorporation which is a evidence that our LLP is registered with the Ministry of Corporate Affairs.

- Step 5:- After incorporation we have to file LLP Agreement with the Ministry of Corporate Affairs within 30 days.

- Step 6:- The Designated Partners can proceed for opening of Bank account and can start their Business.

Ans: Yes we provide Complete post incorporation services such as LLP Audit, Filing of Annual return and Accounts with the Registrar of Companies.